Optimizing Revenue Management In Healthcare

In the Intricate ecosystem of healthcare revenue management, charge posting plays a pivotal role in ensuring accurate billing, timely payments, and efficient financial operations. This comprehensive guide delves into the nuances of charge posting, Its significance in revenue cycle management, and the services offered industry leaders like Fine Claim to streamline these critical processes.

Charge Posting-

Charge posting refers to the process of accurately recording charges for medical services provided to patients.

It involves capturing essential details such as procedure codes, diagnosis codes, service dates, provider information, patient demographics, and insurance details.

Effective charge posting is crucial for generating accurate claims, facilitating timely reimbursements, and maintaining compliance with regulatory requirements.

Importance Of Charge Posting In Revenue Cycle management

Charge posting serves as a cornerstone of revenue cycle management (RCM) in healthcare. Key benefits and importance include

- Accuracy in billing: Proper charge posting ensures that bills accurately reflect the services rendered, reducing billing errors and claim denials.

- Timely payments: Accurate and timely charge posting expedites the claims submission process, leading to faster payments from payers.

- Compliance and documentation: Detailed charge posting ensures compliance with coding guidelines, regulatory standards, and documentation requirements.

- Revenue optimization: Efficient charge posting contributes to revenue optimization by maximizing reimbursements and minimizing revenue leakage.

- Data integrity: Accurate charge posting maintains data integrity, supporting analytics, reporting, and decision-making processes.

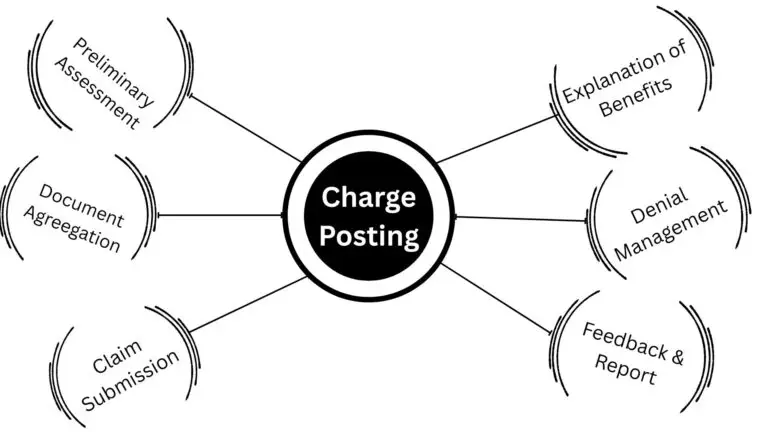

Charge Posting Process At Fine Claim

The charge posting process at Fine Claim follows a structured approach to ensure accuracy, compliance, and efficiency:

- Claim analysis: Thorough analysis of each claim to verify accuracy and completeness of information.

- Documentation check: Ensuring all necessary documents such as medical records, referrals, authorizations are included before claim submission.

- Resubmission and appeals: Resubmitting claims that require additional documentation or appeals for low payment or timely filing issues.

- Denials management: Separating and addressing claim denials promptly, with clear instructions for follow-up actions.

- Quality assurance: Conducting quality audits at every stage to maintain high standards of accuracy and compliance.

- Reporting: Generating detailed reports on monthly collections, accounts receivable aging, practice analysis, collection ratios, and insurance analysis for informed decision-making.

FAQ'S

What is charge Posting?

Charge posting is the entry of service or product charges into a billing system, commonly used in healthcare and finance. It ensures accurate billing by recording relevant details like codes, dates, and costs, supporting claim submission, revenue tracking, and timely reimbursement or customer invoicing.

What is charge posting in medical billing?

Charge posting involves recording the services provided to a patient, including details like CPT/HCPCS codes, ICD-10 codes, units, and modifiers, into the billing system. This step is essential for generating accurate claims for insurance reimbursement.

Why is accurate charge posting important?

Accurate charge posting ensures that healthcare providers are reimbursed correctly and promptly. Errors can lead to claim denials, underpayments, and delays in revenue collection, affecting the financial health of the practice.

Is charge posting a one-time activity?

No, charge posting is an ongoing process that includes data entry, claim submission, payment posting, and denial management. Regular audits and updates are necessary to maintain accuracy and compliance.

What is real-time charge posting?

This refers to charges being posted immediately after service delivery, often through integrated EHR and billing systems, improving speed and accuracy.